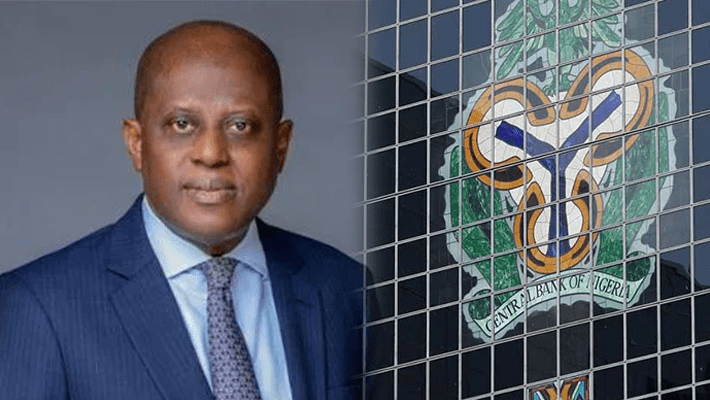

Why CBN insists on another recapitalisation — Cardoso

The Central Bank of Nigeria, CBN, insisted weekend that further capitalisation of banks in the country was for the common good of the nation.

Cardoso, represented at the event by Mr Philip Ikeazor, Deputy Governor, Financial System Stability Directorate, said: “Incidentally, the current manifesto of the Central Bank has embarked on another round of banking consolidation.

‘Why consolidation is necessary’

“Why was it necessary then? Professor Soludo wanted to make the banks robust, resilient, and fit for purpose to grow the economy. And that is exactly the same reason we are embarking on a similar journey today.

“Again, I think by coincidence, if you check the quantum of the capital, minimum capital levels that we require, it’s pretty similar, because international banks are moving from N50 billion to N500 billion, which is 10 times, similar to Soludo’s 12 and a half times, and national banks are moving from N25 billion to N200 billion, roughly about eight times. Why would you think this is the quantum leap? “Basically, when you do consolidations, you would look at the macroeconomic headwinds, the macroeconomic conditions on ground, and, of course, apply your stress tests. And when you apply stress tests today, which I’m sure some of the big banks have done, they would have taken a guess where the capital levels were going to land.

“If you compare the bank assets in Nigeria to GDP, and compare it to similar economies in Africa, you can see they were way behind. So, this exercise is also to strengthen the financial system, make it robust to be able to meet the expected headwinds.

“Remember that when the current administration came into place, there was unification of FX rates, and there was removal of fuel subsidies. And the impact on the economy, the manufacturing sector, is beginning to manifest, or has started manifesting in 2024, and will continue over the next few years.

“So it is important that the banks were recapitalized to the level where they’ll be able to absorb any shocks that come, and also position the banks to be able to grow the economy.

“So, Professor Soludo had laid the foundation 20 years ago of taking the bold decisions required to drive the economy. One of the questions raised and comments passed on interest rates, economic growth and everybody’s debating what it should be. But I’d like to remind people that once you do not tame and control inflation, and you get into hyperinflation, I think it takes you several years to get out of it.

“There’s a South American country that still has very significant oil reserves, but they are in hyperinflation. And I think everybody is aware of what’s happening in those economies. We have our brothers in East Africa who are in the world and are in hyperinflation. We know how hard they’re struggling to come out of that.

“So for us at the Central Bank, focusing on our core mandate of price stability, maintaining a stable exchange rate, and, of course, economic growth, but it’s a question of sequencing, because it’s very important that we do not enter hyperinflation, because once you enter hyperinflation, the transmission of monetary policy tools becomes completely ineffective.

‘’It is important that we avoid that. And they’ve been asked the question, how long will you maintain high interest rates? That would be for as long as we are able to control and start to reverse galloping inflation.

“I think we’re all aware that in the Western world, they did have rate hikes to be able to control theirs, and they maintained it for a very long time. It’s only now that they stopped rate hikes, but they have not even started dropping the rates as we speak.

“So it’s important that we tighten and hold on a little while, and we expect that in no distant future, we will be able to start slowing down on the rate hikes.’’

‘Banking, financial system changed forever’

Meanwhile, eminent Nigerians, including former President Olusegun Obasanjo; former Central Bank of Nigeria, Prof. Chukwuma Soludo, Governor Babajide Sanwo-Olu, among others, described bank recapitalisation carried out 20 years ago from N20 billion to N250 billion as a disruptive change that changed Nigerian banking and financial system forever.

Obasanjo, who was represented by former Cross River State governor, Donald Duke, believed that working with the right team was paramount in every economy.

He said: “I believe that I am that one man because I put together the team. It’s like a coach, a football manager, you pick the captain, and the captain was Captain Soludo.

“But, without the team, they are not going to win a match. So, Captain Soludo has saluted his team,but I take pride in having put together the team.”

Earlier in his speech, Sanwo-Olu, said the book came at a time to reflect as economists, bankers, opinion leaders, businessmen and politicians and look at how Soludo’s team survived those challenges.

‘’We’re also at a point where the current CBN and the leadership are going through a similar exercise, banking consolidation, increment in share capital and the rest of it.