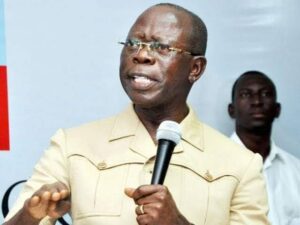

Oshiomhole: VAT resistance is a Nigerian thing — tax evaders should go to jail

Adams Oshiomhole, senator representing Edo North, has said resistance to the payment of Value Added Tax (VAT) is peculiar to Nigeria, arguing that tax evasion should attract stiff punishment, including jail terms.

Oshiomhole made the remarks on Wednesday during his appearance on Channels Television’s Politics Today, where he spoke on the newly enacted tax laws and the ongoing public debate surrounding taxation in the country.

According to the former national chairman of the All Progressives Congress (APC), paying taxes is a civic responsibility in most parts of the world, noting that Nigeria’s challenge lies not in the tax laws themselves but in widespread resistance to compliance.

“Tax resistance is largely a Nigerian thing,” Oshiomhole said. “In many countries, people understand that taxes are necessary to run government and provide public services. Here, people want the benefits but resist contributing.”

He explained that the new tax laws were deliberately structured to protect low-income earners, stressing that the burden of taxation is not meant to fall on the poor but on those with the capacity to pay.

Oshiomhole argued that exemptions and safeguards have been built into the framework to shield vulnerable citizens, while ensuring that businesses and high-income earners contribute fairly to national development.

The senator also warned that deliberate tax evasion undermines governance and economic growth, insisting that strong enforcement measures are required to change attitudes toward taxation.

“People who deliberately evade taxes should go to jail,” he said, adding that sanctions are necessary to deter abuse and instill fiscal discipline.

He maintained that effective tax collection is critical for funding infrastructure, education, healthcare, and other essential services, especially as the government seeks to reduce dependence on borrowing and oil revenues.

Oshiomhole urged Nigerians to see taxation as a shared responsibility and called on authorities to ensure transparency and accountability in the use of public funds to build trust and encourage compliance.