JUST IN: Tinubu Vows To Clear All Forex Backlog

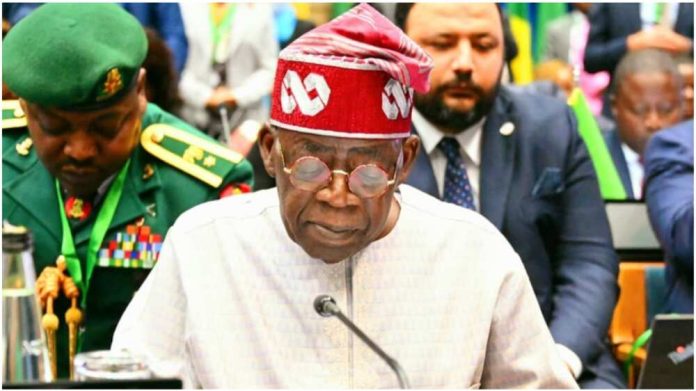

President Bola Ahmed Tinubu has declared that his administration will clear the foreign exchange contracts backlog, which is discouraging investors’ confidence in the country.

Reports showed that the Nigerian leader made the declaration on Monday while speaking at the ongoing Nigeria Economic Summit #NES29 in Abuja.

Tinubu also assured that Nigeria will honour all future Foreign exchange contracts.

All foreign exchange future contracts will be honoured by this government. I assure you we have a line of sight to the foreign exchange we need to refloat this economy. And we will get it,” Tinubu said.

It was gathered that Tinubu’s assurance is coming as, at the time, Nigeria’s currency, the Naira, records further declined due to the increasing scarcity of the US Dollar.

READ ALSO: Certificate Saga: APC USA Warns NADECO Against Embarrassing Tinubu

It was gathered earlier that naira started trading at 1,175/$ at the parallel market and closed at 1,190/$ last Friday. This is a decrease from two weeks ago when the naira traded at 1,100/$ at the parallel market.

However, there was a slight appreciation in the naira’s value on the Investor & Exporter forex window. It sold at 808.28/$ at the close of trading on Friday, compared to 810.05/$ on Thursday, as reported by the FMDQ. Some Bureau de Change Operators mentioned to journalists that the scarcity of the dollar has made it difficult for them to provide forex to customers.

Earlier, the Central Bank of Nigeria (CBN) issued forward contracts to various Nigerian businesses, guaranteeing the purchase of dollars at a predetermined price in the future.

These contracts were used by banks to open Letters of Credit (LCs) and facilitate the importation of goods from foreign suppliers. However, the CBN has not fulfilled these contracts since February 2023, resulting in a backlog of approximately $3 billion. Additionally, there is an estimated backlog of $10 billion, which includes unsettled contracts with foreign investors. As a consequence of the CBN’s failure to address the dollar backlog, they are facing severe FX liquidity constraints and have been compelled to suspend various transactions, such as school fees and Personal Travel Allowance applications.