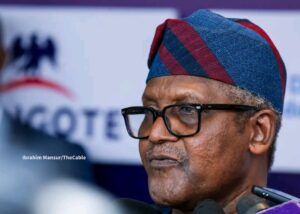

𝗧𝗶𝗻𝘂𝗯𝘂 𝗰𝗮𝗹𝗹𝘀 𝗳𝗼𝗿 𝗳𝗮𝗶𝗿𝗲𝗿 𝗔𝗳𝗿𝗶𝗰𝗮𝗻 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝘀𝘆𝘀𝘁𝗲𝗺

President Bola Tinubu has called for urgent reforms to create a fairer and more balanced African financial system, warning that biased global credit rating practices continue to cost the continent billions of dollars in lost investment opportunities.

Speaking at a high-level economic forum, Tinubu said African economies are often subjected to risk assessments that do not reflect their true economic potential, resulting in higher borrowing costs and reduced access to international capital markets. According to him, the current global financial architecture places African nations at a disadvantage despite ongoing reforms and growth prospects across the continent.

The President argued that Africa must strengthen its financial independence by supporting the establishment of an African-owned credit rating agency. He noted that such an institution would provide more context-based evaluations of African economies and help counter what he described as “structural bias” in global ratings.

Tinubu stressed that inaccurate credit ratings discourage investors, weaken currencies, and increase the cost of infrastructure development. He added that a more balanced system would unlock funding for critical sectors such as energy, transportation, agriculture, and technology, which are key to sustainable development across Africa.

He also urged African leaders to deepen regional economic cooperation, enhance transparency in fiscal management, and adopt policies that promote investor confidence. According to him, building strong domestic institutions remains essential for attracting long-term foreign and local investment.

Economic analysts say the push for a new African financial framework reflects growing frustration among developing nations over the influence of major global rating agencies. Several African governments have previously argued that negative outlooks often overlook economic reforms and resilience demonstrated by local markets.

Tinubu concluded by calling on African governments, development banks, and private-sector stakeholders to collaborate on reforms that will ensure fair access to global finance while protecting the continent’s economic sovereignty.